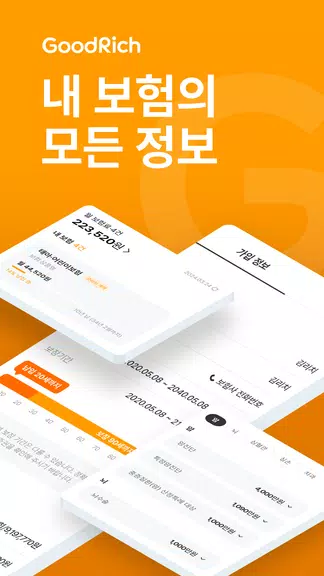

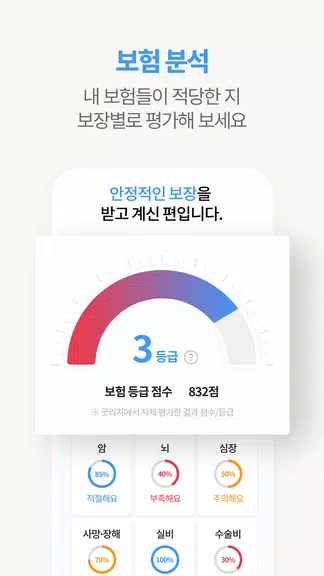

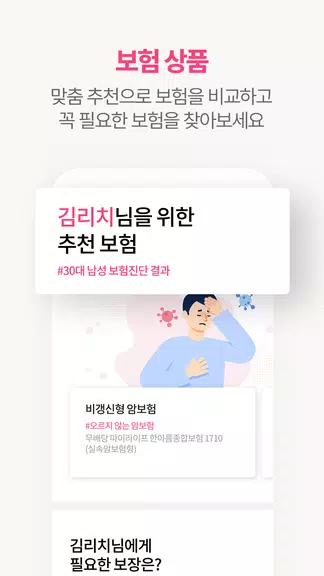

굿리치 – 보험의 바른이치 goes beyond being just an insurance app; it's your comprehensive hub for all insurance-related needs. With 굿리치, you can effortlessly manage all your insurance policies in one convenient location and receive personalized recommendations tailored to your coverage requirements. The app boasts an array of features, including in-depth insurance analysis, seamless claims assistance, and a helpful Q&A section with insurance experts, ensuring you're always well-informed about your insurance. Additionally, tools like the actual loss insurance calculator and health check feature empower you to stay proactive about your overall well-being. Say goodbye to the complexities of insurance and embrace the ease of 굿리치 – 보험의 바른이치!

Features of 굿리치 – 보험의 바른이치:

❤ Effortlessly access all your insurance information in one place, from contract details to coverage status.

❤ Invite family members to join and manage their insurance policies effortlessly.

❤ Evaluate your existing insurance coverage to ensure it aligns perfectly with your needs.

❤ Benefit from personalized insurance recommendations based on your current policies.

❤ Streamline the insurance claims process by submitting information and documents directly through the app.

❤ Tap into a vast repository of insurance-related resources and expert advice via the Q&A section.

Tips for Users:

Consolidate all your insurance policies within the app for streamlined management and instant access to crucial details.

Leverage the claims assistance feature to simplify the process and maximize your potential benefits.

Regularly explore the Q&A section for expert insights on insurance-related queries, ensuring you're always in the know.

Conclusion:

Thanks to the intuitive features of this app, managing and understanding your insurance policies has never been more straightforward. From organizing your coverage to handling claims and accessing expert advice, 굿리치 – 보험의 바른이치 is your ultimate solution for all insurance needs. Download it now to simplify your insurance management and make informed decisions about your coverage.