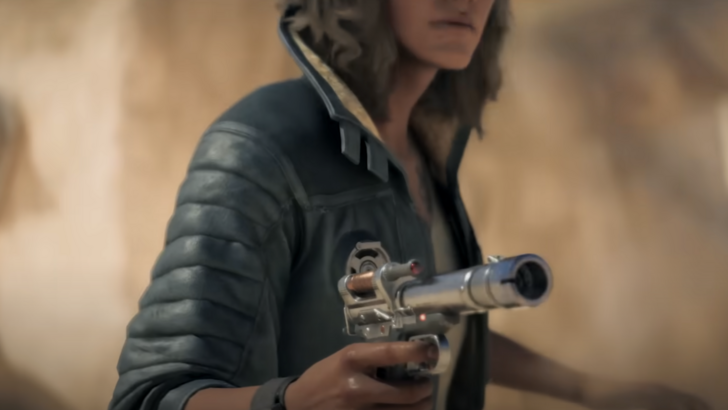

Ubisoft's Star Wars Outlaws Underperforms, Impacting Share Price

Ubisoft's highly anticipated Star Wars Outlaws, intended as a financial turnaround point, has reportedly underperformed in sales, causing a dip in the company's share price. Despite positive critical reception, sales have been described as sluggish.

Share Price Decline

The game's underwhelming sales performance contributed to a consecutive two-day drop in Ubisoft's share price starting September 3rd. The stock fell 5.1% on Monday and a further 2.4% by Tuesday morning, reaching its lowest point since 2015 and adding to a year-to-date decline exceeding 30%. This is a significant blow, considering Ubisoft's reliance on Star Wars Outlaws and Assassin's Creed Shadows (AC Shadows) as key drivers for future growth.

Revised Sales Projections

J.P. Morgan analyst Daniel Kerven lowered his sales projection for Star Wars Outlaws from 7.5 million units to 5.5 million units by March 2025, reflecting the game's struggle to meet initial expectations. This, despite the generally positive critical reviews, highlights a disconnect between critical acclaim and consumer demand.

Ubisoft's Q1 2024-25 report emphasized the importance of Star Wars Outlaws and AC Shadows in their organizational transformation strategy. While the company reported a 15% increase in session days and a 7% year-on-year rise in monthly active users (MAUs) to 38 million, primarily driven by Games-as-a-Service, the disappointing performance of Star Wars Outlaws casts a shadow over these positive metrics.

Mixed Player Reception

The discrepancy between critical and user reception is notable. While Metacritic shows a user score of only 4.5/10, Game8 awarded Star Wars Outlaws a 90/100 rating, highlighting a significant divergence in opinion. This disparity underscores the challenges in predicting market success, even with a strong IP and positive critical response. For a detailed analysis of Star Wars Outlaws, refer to our full review (link omitted).